WHAT WE specialise in

Investment Quality Australian Pink Diamonds

Growth

12% P.A for over 35 years Outperformed all other asset classes.

Stability

No decline in value over GFC and Covid

Supply Cuts

Mine shut in 2020,

90% Supply Cut

SMSF

ATO provisions allow purchase with SMSF

WHAT WE DO

Diversify your portfolio with Pink Diamonds.

Fancy rare coloured diamonds are like Picasso artworks. There may only ever be one of a kind.

Acquire something remarkable the family can treasure for generations. Rare coloured diamonds, are permissible investments inside a Self Managed Super Fund Portfolio (SMSF).

Pink diamonds have outperformed major equity indices.

Numerous economic cycles have occurred in the 39 years of the Argyle mine. Throughout this time, Pink diamonds have retained their value.

In the tumultuous recession of 2008 that was materialising across the world, Rio Tinto received the highest price per carat on a pink diamond. We saw similar during covid.

Pink diamonds have tracked art prices generally with lower volatility.

Parallels are often made with Australian Pink Diamonds and fine art - not only because each polished stone is in itself a work of art, but due to the allure and perpetual value associated with both.

Historically fine art and pink diamonds have sustained their worth and each maintained their status as a definitive collectible, regardless of market condition.

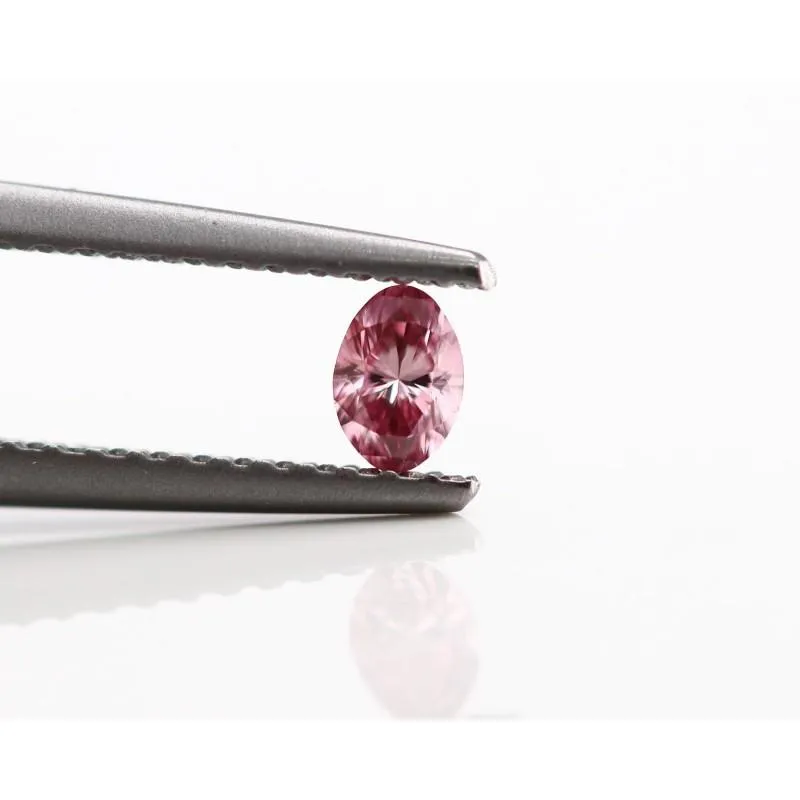

EXCLUSIVE COLLECTION

We deal in the most valuable and sought after gems in the world.

pink diamonds

How We Work

Purpose of Purchase

Will this diamond be purchased with superannuation? Or will the diamond be worn as jewellery?

Select a Budget

Decide how much you would like to spend on this diamond.

We Make the Magic

We'll find the best value pink diamond to suit the purpose of purchase.